The new law expands portability of retirement assets by permitting taxpayers to roll over assets from traditional and sep iras as well as from employer sponsored retirement plans such as a 401 k 403 b or 457 b plan into a simple ira plan.

Roll over 401k into simple ira.

However the tax treatment of the rollover will be dictated by the rollover date.

Get more flexibility with your investments.

Prior to 2016 a simple ira plan could only accept rollover contributions from another simple ira plan.

What you gain from a 401 k rollover.

60 day rollover if a distribution from an ira or a retirement plan is paid directly to you you can deposit all or a portion of it in an ira or a retirement plan within 60 days.

Beyond the type of ira you want to open you ll need choose a financial institution to invest with.

Give your money a fresh start by rolling it over into an ira.

When you left your old job did you leave your retirement savings behind.

You can legally roll over simple ira assets into a 401 k plan.

That means you move a regular 401 k into a traditional ira and a roth 401 k into a roth ira.

You can rollover from a traditional 401 k into a traditional ira tax free.

Taxes will be withheld from a distribution from a retirement plan see below so you ll have to use other funds to roll over the full amount of the distribution.

Just be sure to check your 401 k balance when you leave your job and decide on a course of action.

Same goes for a roth 401 k to roth ira rollover.

Simple iras still may not accept rollovers from roth iras or designated roth accounts within 401 k plans.

Previously a simple ira plan could only accept rollover contributions from another simple ira plan.

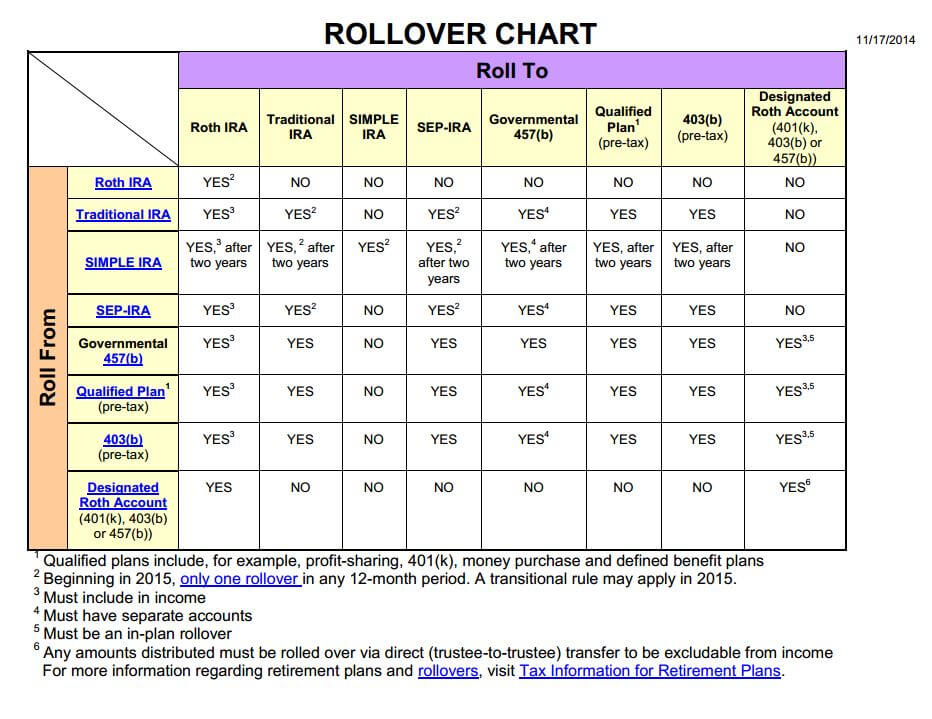

Roll to roth ira traditional ira simple ira sep ira governmental 457 b qualified plan1 pre tax 403 b pre tax designated roth account 401 k.

So if your client has owned her simple ira for two years then she can roll over money into it from another eligible plan.

You can t roll a roth 401 k into a traditional ira.